Nov 2022 Release Notes

November 30, 2022

As winter approaches, we are cooking up a stew of updates. Our Fundraiser Credits feature went live in November. Let’s learn more about it!

Fundraiser Credits

Our fundraiser credits system takes the total earned from your fundraiser and applies that amount evenly to all students assigned certain fees. For example, if you earned $1000.00 and have ten students going on the trip, applying that fundraiser credit will reduce the trip fee for each of those students by $100.

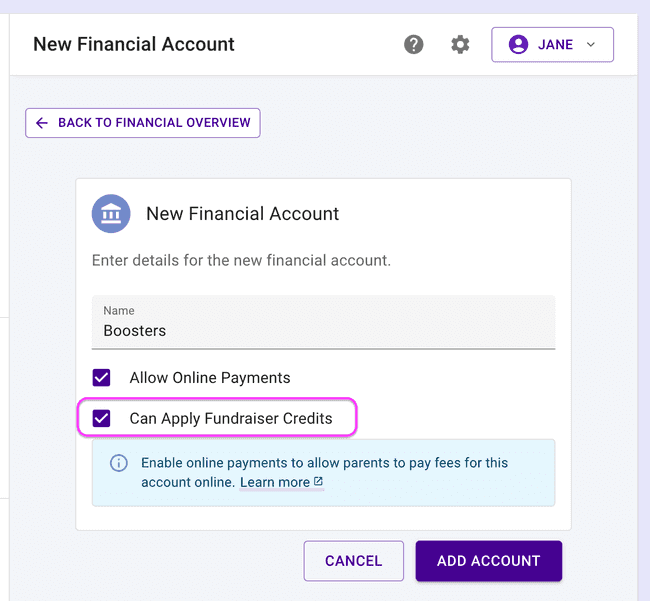

- A financial account can be designated to apply fundraiser credits. Add or edit a financial account to allow fundraiser credits.

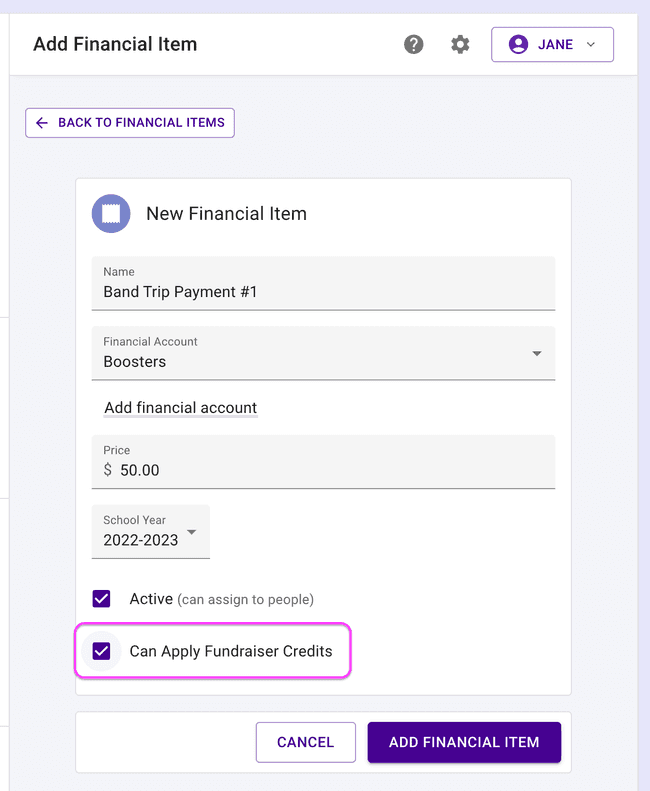

- Next, add or edit a financial fee to allow fundraiser credits.

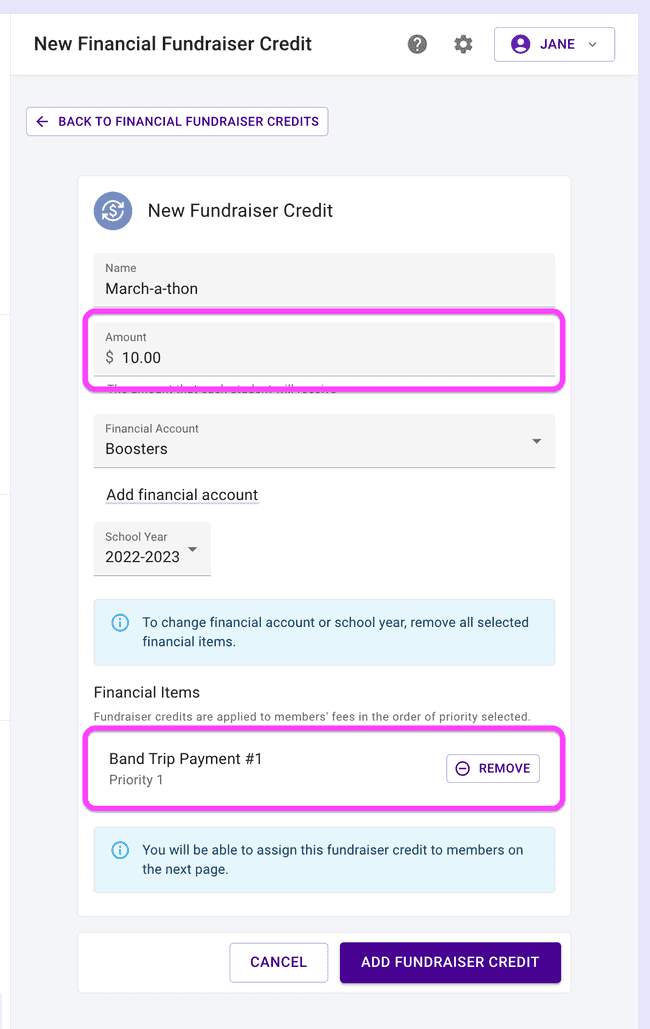

- When the fundraiser is finished, you should know the total amount earned by the group. Create a new fundraiser credit. The amount entered is how much the selected fees are reduced for each student. Select which fees can be reduced by fundraiser credits.

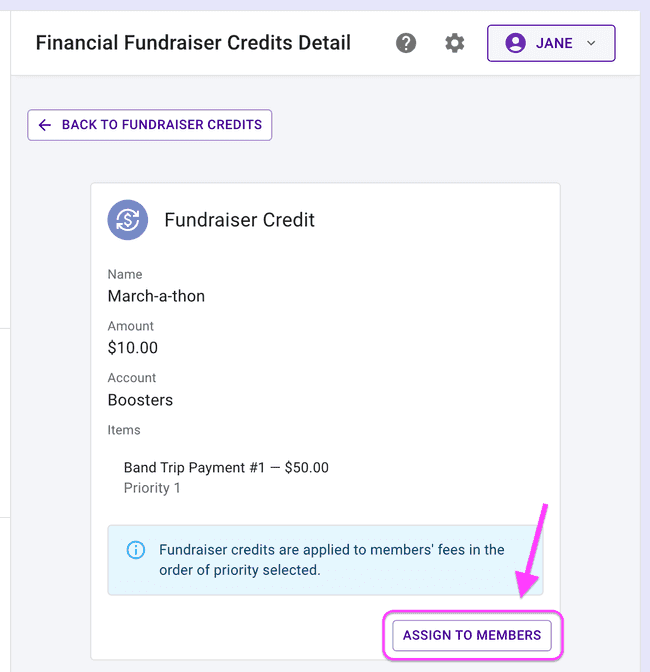

- Assign students to the fundraiser credit. This is probably all of the students assigned to the fees you selected in step 3. We allow fine-grained selection in case a situation changes like a student dropping out of the trip.

We hope this new feature gives some flexibility to your organization applying fundraiser credits. We also want groups to use it responsibly.

Fundraiser Credits notes:

- In the US, IRS rules state that a non-profit organization cannot keep “Individual Fundraising Accounts” (IFAs). All funds raised must be applied to the organization’s general fund that supports all students, regardless of whether they participated in the fundraiser. Presto Assistant does not support IFAs.

- If your organization isn’t non-profit or you have a different set of rules in your district or booster club, we encourage you to use a separate spreadsheet to track your group’s fundraiser credits.

- A non-profit group found by the IRS to be in violation of the IFA guidelines can face fines and penalties and possible loss of tax-exempt status.

- This IRS document provides guidance about Charitable Organizations. Also, a quick internet search will turn up dozens of articles about the IRS rules on IFAs.

- The team at Presto Assistant cannot provide legal advice. Please consult with your district’s legal counsel or financial office with questions about your specific situation.

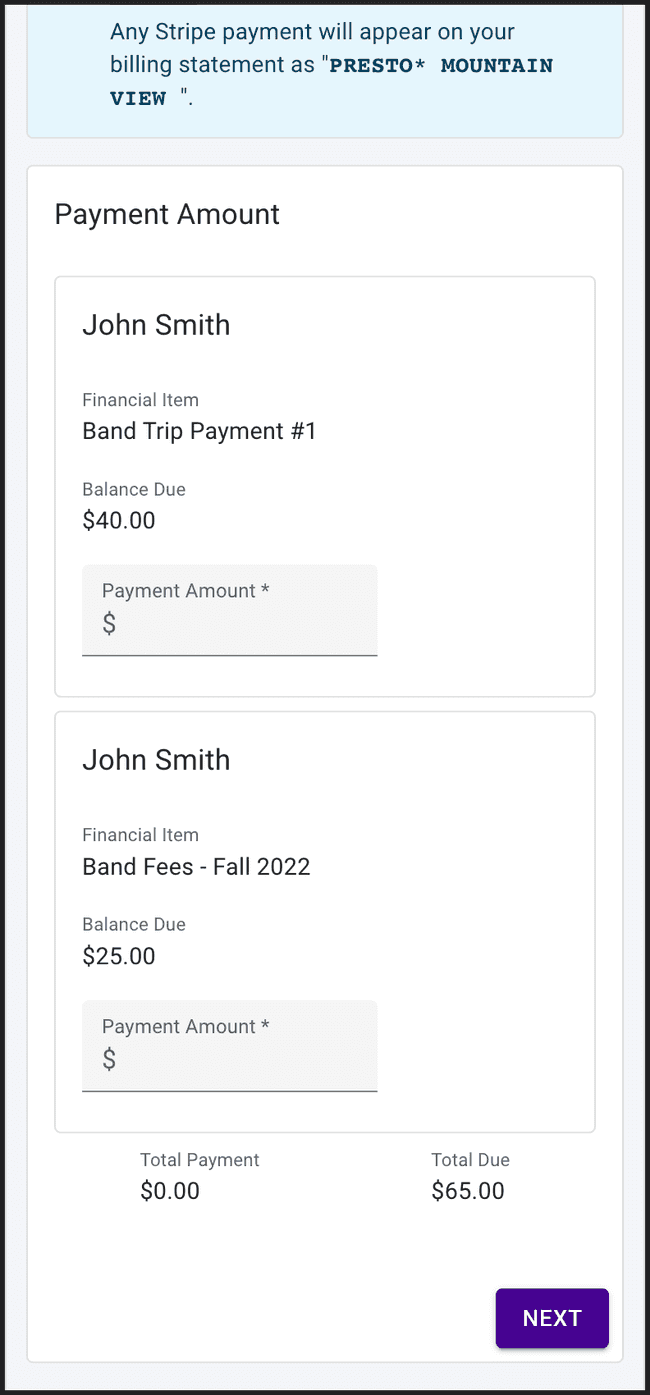

Mobile Payments

Parents tell us that they love making payments directly in Presto. Parents can make partial payments or pay for multiple students at once.

For parents making Stripe payments on a small screen, we will stack the fees owed to make it easier to see all information without any scrolling.

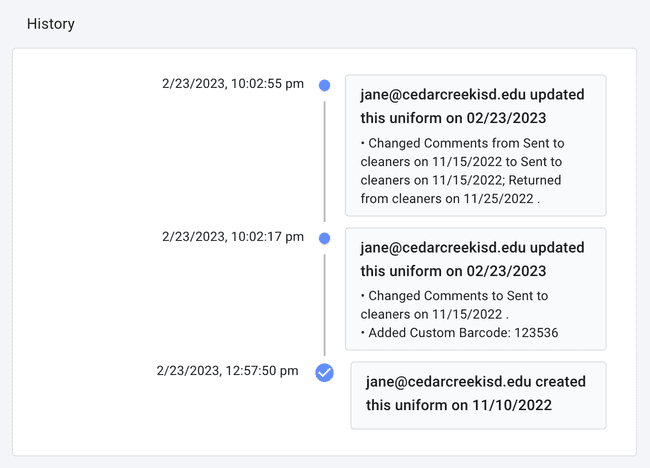

Uniform History

Like many other parts of our web application, we now show the history of uniform parts on the details page for each item. We keep track of changes for an audit history for many parts of the system for accountability and transparency.

Terms of Service

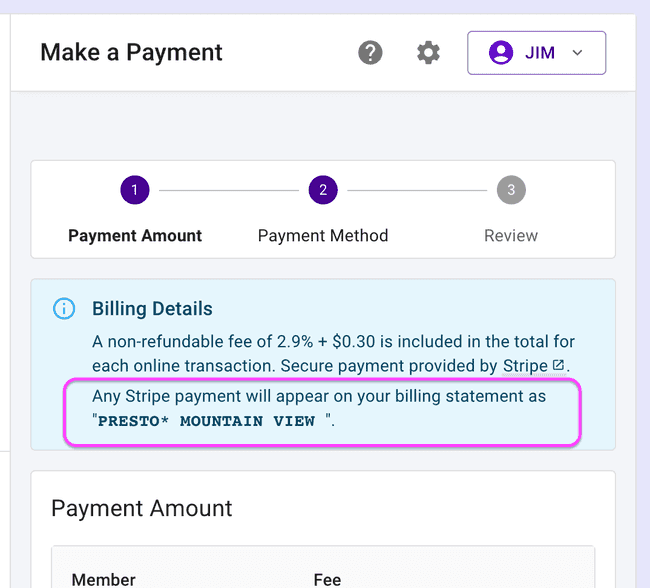

Our Terms of Service page is updated with new guidelines on how we handle fees related to Stripe payment disputes. Everyone loves to read the TOS, right?

Please remind parents that payments they make through Presto will appear on their billing statement like PRESTO* ORG NAME, though your organization name might be shortened to fit on the statement. We also show the parent this information on the screen where they make a payment.

Other Items

- We have a new Testimonials page where people said some very nice things about Presto Assistant. Y’all are the best!

- The Parents table now uses the updated table view that shows all data and supports multiple filters.

- If you waived a fee for a student but need an “undo” button, we’ve got you. Now you can “Unwaive” a fee that was previously waived.

Get in Touch

Please contact Presto support with any questions or suggestions.